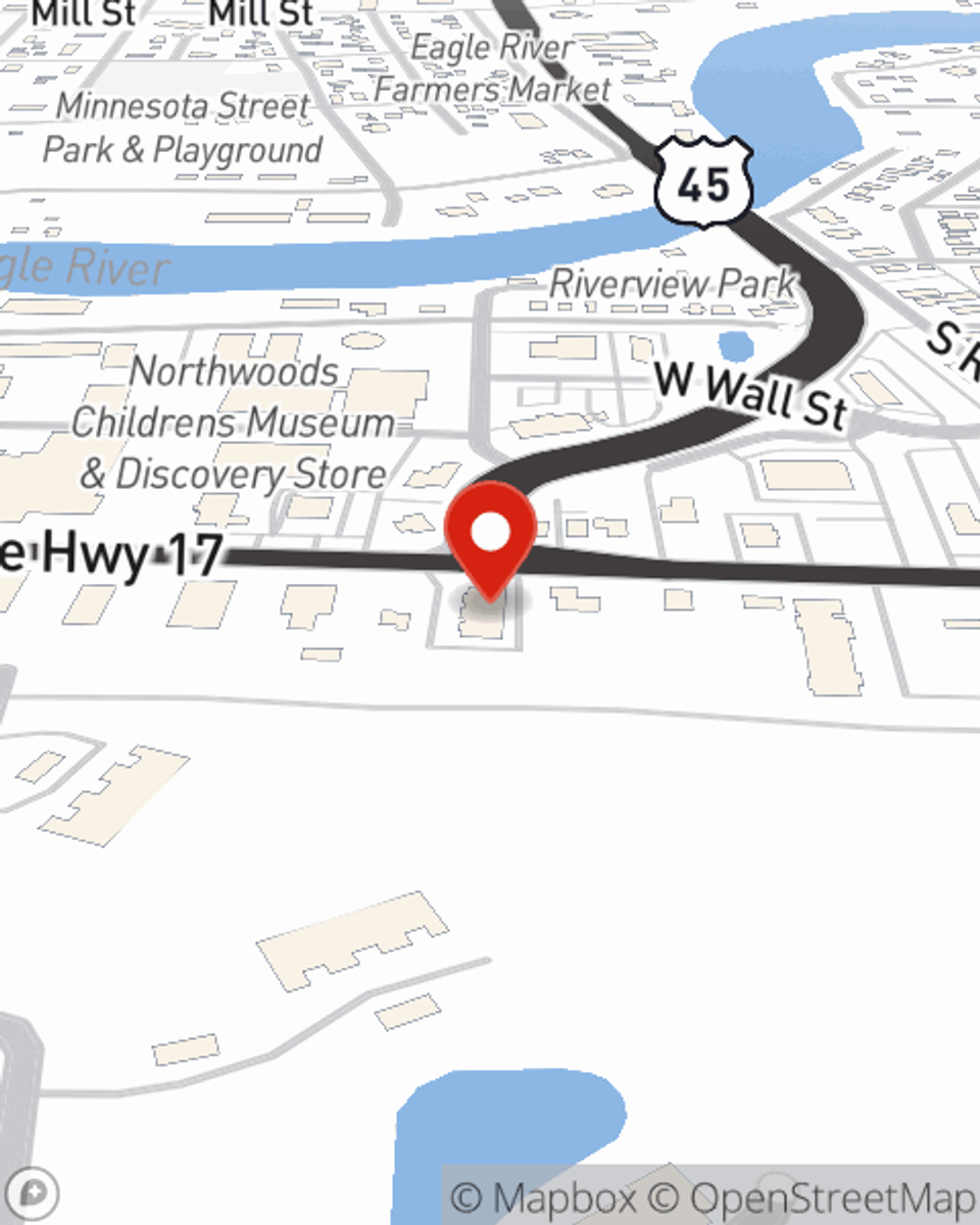

Business Insurance in and around Eagle River

One of Eagle River’s top choices for small business insurance.

This small business insurance is not risky

Help Protect Your Business With State Farm.

Preparation is key for when an accident happens on your business's property like an employee getting hurt.

One of Eagle River’s top choices for small business insurance.

This small business insurance is not risky

Small Business Insurance You Can Count On

The unexpected is, well, unexpected, but you shouldn't wait until something happens to make sure you're properly prepared. State Farm has a wide range of coverages, like worker's compensation for your employees or business continuity plans, that can be molded to develop a personalized policy to fit your small business's needs. And when the unexpected does arise, agent Ben Rabenn can also help you file your claim.

Ready to investigate the specific options that may be right for you and your small business? Simply get in touch with State Farm agent Ben Rabenn today!

Simple Insights®

Commonly asked Business Continuation questions

Commonly asked Business Continuation questions

Check out the answers to these commonly asked business continuation questions.

Trailer insurance coverage

Trailer insurance coverage

Consider trailer insurance coverage to help protect the value of your trailer.

Ben Rabenn

State Farm® Insurance AgentSimple Insights®

Commonly asked Business Continuation questions

Commonly asked Business Continuation questions

Check out the answers to these commonly asked business continuation questions.

Trailer insurance coverage

Trailer insurance coverage

Consider trailer insurance coverage to help protect the value of your trailer.